The majority of states have disallowed business from including this exemption, but it's still legal in some. Most long-lasting care insurance plan permanently omit advantages being paid for specific conditions. Keep an eye out for typical conditions left out, such as specific forms of cardiovascular disease, cancer or diabetes. Other exemptions include: Psychological or anxious conditions, not counting Alzheimer's or other dementiaAlcohol or drug abuseAttempted suicide or intentional self-harmTreatment in a federal government center or already spent for by the governmentIllness or injury brought on by an act of war Policies released to policyholders with pre-existing conditions Check out here normally consist of a momentary exclusion. Pre-existing conditions typically won't be covered for a set duration of time.

Avoid policies with exclusion durations longer than 6 months. There aren't any age limitations on when you can buy long-term care insurance coverage, but it's more expensive and more difficult to get approved the older you get. For this reason, most individuals buy their policies in their 50s or early 60s. Insurance provider might recommend buying a policy as young as 40, however Consumer Reports advises waiting until age 60.

According to the AALTCI, few insurance provider even provide coverage to anybody over the age of 80 and a person over 80 who in fact passes the health credentials probably would not be able to afford the premium. Determining the very best time for your enjoyed one to buy a policy really depends on what they desire their long-lasting care insurance to achieve.

It's never ever too early to think about purchasing long-term care insurance, recommends Duane Lipham, a Certified Long-Term Care specialist. As you're helping your liked one buy their policy, you may likewise want to think about coverage on your own if you meet the requirements because impairment isn't limited to age borders. If your enjoyed one is mainly concerned about safeguarding their assets in retirement, at what age does it make the most cost-effective sense for them to seriously think about buying long-lasting care insurance? Lipham typically advises purchasing at a more youthful age, somewhere in between the ages of 45 and 55, for 2 main factors: It's reasonably cost effective.

Many people usually still enjoy a step of health at this stage in life and can get additional premium discounts for having an excellent health history. They can lock in these lower premium rates for the remainder of their lives. After the age of 55, Lipham warns that premium costs do begin to speed up more rapidly and increase significantly from year to year in an individual's mid-60s.

While searching for long-lasting care insurance for somebody in your care, consult their present or former employer, life insurance supplier or insurance coverage broker to see if they can include coverage to an existing policy. Nevertheless, to ensure they're getting the best strategy, likewise get quotes from several other sources.

Selecting the best strategy from all these choices hinges on a number of aspects. Age impacts the expense of the selected plan, and picking the best features, specifically the everyday advantage and inflation security, affects the care received. Compare strategies thoroughly to world time share now guarantee your loved one finds an inexpensive policy that doesn't compromise protection.

Indicators on How Much Do Vaccines Cost Without Insurance You Need To Know

If you have actually already purchased insurance however find it's not what you thought, a lot of states need a 30-day cancellation duration. The insurance provider is needed by law to issue a refund on any policy cancelled prior to this time frame ends. Like any insurance, long-lasting care insurance is a financial gamble. Your enjoyed one is wagering years of premiums against the likelihood how to get rid of a wyndham timeshare of a long stretch of expensive long-lasting care.

As an included precaution, try to find policies that supply some refund security if after a rate hike the policyholder can't keep paying the higher policy premiums. A good refund arrangement can make one policy more appealing over other comparable alternatives. There are a number of types of conventional stand-alone long-term care insurance plan, but they all run on the same concepts as other types of insurance coverage.

Some policies pay advantages based upon a day-to-day limitation, and others increase that daily amount by 30 to develop a regular monthly advantage amount. You can easily assist your liked one figure out a sensible everyday benefit quantity by calling regional nursing facilities and house healthcare agencies to discover the average cost for these services in your area.

Also, request for rates for both private and semi-private spaces because there's frequently a substantial cost difference. It is necessary the everyday benefit effectively covers center care expenses, which is sometimes the greatest cost. Once you have an excellent concept of the day-to-day expenses associated with regional long-lasting care, choose how much of that everyday amount you feel your loved one could fairly co-insure out of their own funds.

Some individuals believe they must over-inflate the everyday advantage quantity to guarantee they keep pace with the rising expenses of care. It's true that long-term care costs are rising so quickly that an ideal everyday advantage today may be just half of what is needed in just 15 years or so.

Inflation security guarantees the policy somebody purchases today isn't worthless when they're prepared to collect on it. Due to the ever-increasing expense of healthcare, if your liked one bought a policy with a flat rate without inflation security, this quantity probably will not cover daily costs in 15 or twenty years when they require it.

This arrangement increases the quantity of the policyholder's benefit over the years they keep the policy. Most policies put a time limit on inflation defense, which is typically 10 to 25 years from the date the policy was purchased. Other policies stop inflation defense when the policyholder reaches a specific age, usually 80 or 85.

How Much Insurance Do I Need - An Overview

Either way, ensure the policy includes it. The very best types of inflation defense include: Intensifying automatic boost, which instantly increases advantages yearly and utilizes the increased advantage amount as the base for computing the next year's increase. Easy automated increase, which immediately increases benefits every year however uses the policy's initial advantage total up to determine the increase.

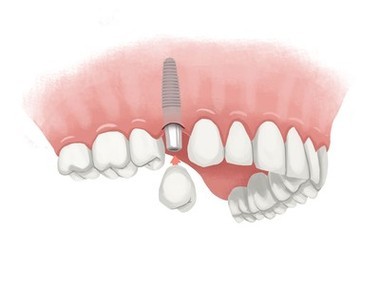

The efficiency of the inflation defense benefit is carefully linked to making sure the day-to-day advantage is as high as possible. Do your homework to guarantee your liked one has the defense they need now and several years into the future - how much does a tooth implant cost with insurance. When it pertains to older people and cash, scams is something to view out for.

Always inspect the insurance business's rating and complaint history with your state insurance coverage commissioner before signing any contracts or making any payments. If a company has a consistent pattern of problems or a bad performance history of honoring claims, choose a different business. Your enjoyed one isn't most likely to collect on their policy for a number of years.

While there's no chance to ensure an insurance business will stay in business, make sure it remains in good monetary shape for the foreseeable future by investigating its monetary health through Moody's Investors Solutions or Standard & Poor's insurance ranking services. An insurance coverage company's financial strength ranking is likewise the very best indication of its capability to pay out on benefit claims.